Avoid Common Mistakes When Buying Off-Plan Properties in Dubai

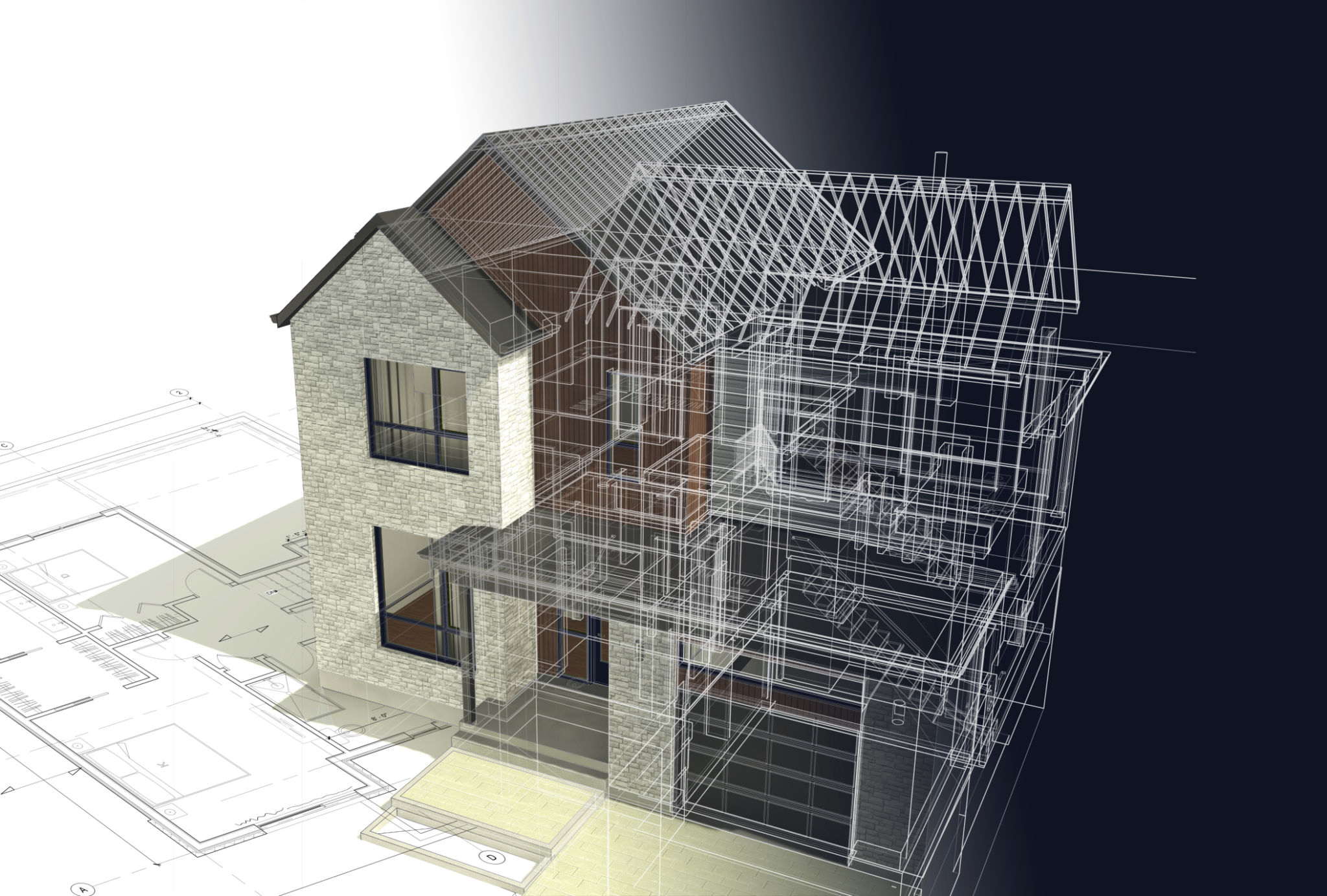

Understanding Off-Plan Properties

Investing in off-plan properties in Dubai can be a lucrative opportunity if approached with caution and due diligence. An off-plan property is essentially a property that is sold before its construction is completed, often at a lower price than completed properties. This can be a great way to secure a property at a favorable rate, but it also comes with its own set of risks and considerations.

Research the Developer

One of the most crucial steps in purchasing an off-plan property is researching the developer. The reputation and track record of the developer can provide insights into the potential success and quality of your investment. Look for developers with a history of completing projects on time and delivering what was promised.

It may be beneficial to visit some of their completed projects to assess the quality and design firsthand. Additionally, reading reviews and seeking feedback from other investors can help you make an informed decision.

Review the Payment Plan

Off-plan properties often come with flexible payment plans, which can be advantageous for buyers. However, it's essential to thoroughly understand these plans and ensure they fit within your financial capabilities. Consider any potential changes in your financial situation that might affect your ability to make payments on time.

Ensure that the payment plan is structured in a way that doesn't leave you overly exposed financially. A well-balanced payment plan can provide peace of mind and help manage your cash flow effectively.

Understand the Contract Terms

The contract for an off-plan property purchase should be reviewed meticulously. It's vital to understand all terms, including any clauses about delays, refunds, and penalties. Engaging a legal expert who specializes in real estate can be invaluable in this process, ensuring that your rights are protected.

Pay attention to the expected completion date and any conditions that might allow for extensions. Clarity on these terms can prevent future disputes and provide a clear roadmap for your investment.

Location and Market Trends

Location plays a critical role in the potential appreciation of your property. Research the area where the development is taking place to understand its growth prospects, infrastructure plans, and community developments. A property in an up-and-coming area could significantly increase in value over time.

Stay informed about market trends in Dubai's real estate sector. Understanding supply and demand dynamics, as well as government regulations, can provide a clearer picture of the potential return on investment.

Verify Completion Guarantees

Completion guarantees provide a safety net for buyers, ensuring that the project will be completed as promised or compensating them if it isn't. Check if the developer offers such guarantees and understand the conditions under which they apply.

This assurance can reduce the inherent risks associated with off-plan purchases, giving you more confidence in your investment decision.

Inspect the Property Before Completion

If possible, schedule visits to the construction site to monitor progress. This will not only keep you informed but also allow you to address any concerns with the developer early on. Regular updates on construction milestones can help you gauge whether the project is on track.

Being proactive about inspections can ensure that any deviations from the original plan are rectified before the handover.

Conclusion: Make Informed Decisions

Buying an off-plan property in Dubai requires thorough research and careful consideration of various factors. By avoiding common pitfalls and being an informed buyer, you can capitalize on this opportunity while minimizing risks. With diligent planning and strategic decision-making, off-plan properties can offer significant rewards.